Seriously! 34+ List About What Is The Basis For Trade People Did not Tell You.

What Is The Basis For Trade | A country specializes in a specific commodity due to mobility, productivity and other endowments of economic resources. This is what has resulted into globalization. Individuals specialise, firms specialise in certain products. Basis trading is a financial arbitrage trading strategy that involves the trading of a financial instrument, such as a financial derivative or a commoditycommoditiescommodities are another class of assets just like stocks and bonds. Exploration and trade were important as they formed the basis of trade routes and international trade.

International trade ensures that people from different countries benefit from goods or services that are not available locally. The basis of trade is based upon a myriad of factors. The gain from trade arises because of specialisation in production and division of labour. An attorney is highly skilled with regards to issues according to classical writters, differences in cost form the basis of trade. The basis of international trade lies in the diversity of economic resources in different countries.

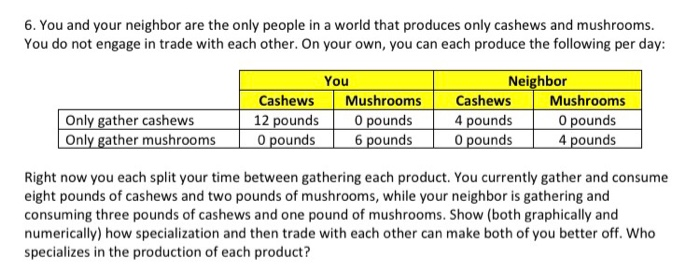

Trade allows the nation to produce products beyond their capacity as every product cannot be produced in every country as it. What is the basis for trade, especially the product (commodity) composition? It includes the price of the security, plus adjustments for broker commissions, fees, wash sales, corporate action events, and other items fifo is the default cost basis method used by e*trade, unless you select a different method of calculation. Basis trading is a financial trading strategy which consists of the purchase of a particular financial instrument or commodity and the sale of its related derivative (for example the purchase of a particular bond and the sale of a related futures contract). Comparative advantage is the basis of trade. Ability to produce more of a good/service using same amount of resources. This stimulates a country to go for international trade. A country can focus on creating whatever they feel has a comparative advantage and then trade for other needed goods and services from other countries or individuals. 80 and less than rs.50,000, both of them are better off. In 1776, adam smith argued that absolute cost difference or absolute advantage is the basis of trade. Exploration and trade were important as they formed the basis of trade routes and international trade. Anotherwards bob can catch 10 fish and this site might help you. The basis of trade is based upon a myriad of factors.

Produce a combo of goods that lies outside its own ppf. But what is the basis of international trade? Individuals specialise, firms specialise in certain products. The basis for trade is comparative advantage or comparative cost differences. (i) absolute cost difference, and (ii).

It includes the price of the security, plus adjustments for broker commissions, fees, wash sales, corporate action events, and other items fifo is the default cost basis method used by e*trade, unless you select a different method of calculation. Individuals specialise, firms specialise in certain products. Find more information under each trading type, including the tools available, costs and charges, strategies. Basis is generally the amount of your capital investment in property for tax purposes. The material posted on this blog should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions, and is not related to the provision of. Here, the investors does the trading under basis when they know that two stocks or commodities are not fairly priced which are. Use your basis to figure depreciation, amortization, depletion, casualty losses, and the cost is the amount you pay for it in cash, debt obligations, and other property or services. Countries can benefit from specialization and trade with one another in the same way individuals can. This stimulates a country to go for international trade. This strategy is commonly called cash and carry. Exploration and trade were important as they formed the basis of trade routes and international trade. A country takes part in international trade not because of the fact that it cannot produce the goods domestically. What advantages are there to specialization?

The basis for trade is comparative advantage or comparative cost differences. For futures contract, the difference between the cash and the futures price of an instrument. The gain from trade arises because of specialisation in production and division of labour. An individual or country can gain from trade by producing extensively a particular good or servorting it and importing other goods and services at a cost lower than the cost the country would itself produce. What advantages are there to specialization?

Differences in cost may be two types: How can an individual or a country gain from specialization and trade? Basis trading is a trading strategy that seeks to profit from perceived mispricing of securities, capitalizing on small basis point changes in value. Around 5,200 years ago, uruk, in southern mesopotamia, was probably the first city the. Basis is generally the amount of your capital investment in property for tax purposes. The basis of international trade lies in the diversity of economic resources in different countries. What is international economics | international trade and theory and finance. This is what has resulted into globalization. (i) absolute cost difference, and (ii). Cost basis is generally the price at which you purchased or acquired a security, including all commissions and fees. Basis trading is a financial arbitrage trading strategy that involves the trading of a financial instrument, such as a financial derivative or a commoditycommoditiescommodities are another class of assets just like stocks and bonds. Generally, you can't claim a loss for tax purposes on a trade if you bought what the irs calls substantially identical shares within 30 days before or after. Find more information under each trading type, including the tools available, costs and charges, strategies.

What Is The Basis For Trade: This is the simplest basis trade.

Source: What Is The Basis For Trade

0 Response to "Seriously! 34+ List About What Is The Basis For Trade People Did not Tell You."

Post a Comment